Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Service Quality Model for Modern Retail Banks in India – A Questionnaire Development and Validation

Authors: Swayansidha Mishra, Dr. Manmath Nath Samantaray

DOI Link: https://doi.org/10.22214/ijraset.2024.64121

Certificate: View Certificate

Abstract

With significant changes in the Indian banking sector, private sector and foreign banks greatly emphasise the standardisation of \'high-tech\' services and their application in retail banking. The shift in how modern banks are perceived for the quality of their services in recent years has made it more important for scholars and professionals to comprehend its facets. Prior research on this concept has mainly focused on the SERVQUAL model (developed by Parasuraman et. al, 1988). The theoretical contribution of the present study lies in extending the SERVQUAL model to modern retail banks in India. The study starts with identifying and testing dimensions of service quality. Based on the analysis of data collected from 173 customers of different banks, the questionnaire has been found to be reliable and valid for measuring various dimensions of service quality in modern banks in India.

Introduction

I. INTRODUCTION

Various changes have occurred in the Indian banking sector. As a result of globalisation and liberalisation, it has achieved the milestone of nearly 100 per cent Core Banking System (CBS) deployment and a high level of transaction (about 200 transactions) each day per ATM. This is reflected in the daily retail banking services provided by a few banks in each category, which are close to the highest in the world, and will shortly overtake China and the United States to become the world’s third–largest banking sector by 2025 (Tripathi and Poddar, 2011).

Indian banks have made it a priority to create value for their customers. Banks are under strong competition as a result of globalisation, privatisation, and liberalisation. Despite this, Indian banks continue to innovate to add value to their customers. Between 1990 and 2000, there was a significant transformation in financial services, accompanied by innovation, all of which contributed to client comfort and security. Banking and financial services rely heavily on innovation and technology. Indian banks have offered a wide range of services through ICT. Plastic money, various modes of online money transfers such as Wallet, UPI, RTGS, NEFT, IMPS, and Electronic Clearance Systems, Cheque Truncation System make the work of bank staff easier. It also provides clients with convenience and security. Customers benefit from the flexibility and convenience of an E-banking service that is available 24 hours a day, seven days a week.

The modern banking system has included technology as the primary source of delivering quality services to customers. Service quality plays an important role in attracting and retaining customers. This has been identified as a strategic requirement in highly competitive business environments (Parasuraman et al., 1985, Zeithmal et al., 1990). Organisations provide greater service quality to increase their market share and profitability. Similarly, Edvardsson (1998) noted that the customer's total view of the service is determined by his or her perception of the service supplied and how it was delivered. The service quality aspect of the bank can be measured in different dimensions and some new dimensions can be incorporated for the satisfaction of the customers. This research has been undertaken to understand the service quality of modern banking systems and how these are leading towards customer satisfaction.

II. REVIEW OF LITERATURE

Over the last 20 years, research on service quality has grown extensively and substantively. The service quality model gained a lot of attention after the revolutionary work of Parasuraman, Valarie Zeithaml and Len Berry in 1985. Parasuraman et al., (1985) looked at service quality as a comparison differentiation between the customer perception and expectation of the service and the actual performance of the service received by the customer provided by the company at a certain period.

Cronin and Taylor (1994) developed the SERVPERF scale in which expectations (E) are excluded and therefore, service quality is evaluated by the perceptions of the customers regarding the performance of the service delivered by using the same five dimensions of SERVQUAL. The SERVQUAL model has provided a comprehensive conceptualisation of service quality with an instrument to measure perceived service quality.

This method has been very popular with academics and researchers to assess the customer perception of service quality for a variety of service industries. The five dimensions of service quality include (1) Tangibles (appearance of physical components); (2) Reliability (dependability of service provider and accuracy of performance); (3) Responsiveness (promptness and helpfulness); (4) Assurance (knowledge and courtesy of employees and their ability to inspire trust and confidence); and (5) Empathy (caring, individualized attention the firm gives its customers). Despite its popularity, it has been challenged by several researchers and raised questions about its practical applications. The problem of when to measure it, either before or after receiving the service (George & Kumar, 2014) and the notion that the model uses perceptions and expectations of a subtractive “gap” (P-E) as a measure of quality (Al-hawari, M. A., 2015).

Zeithaml et al., (2011) refer to the degree of excellence of service performance and is viewed that service quality as subjective. Ennew and Waite (2013) discussed the customer’s perception of how well the service matches their needs and expectations and they compare the actual service with the expected service.

As modern services are usually new things for customers, hence less information and less awareness prohibit people from adopting modern banking. Sathye (2002) highlighted that developing awareness about the products and services in customers is a significant factor in adopting modern services.

Flavian et al., (2004) identified factors like access to service, service offered, security, and reputation for measuring service quality. In this study, authors measured corporate image especially in the case of the Internet banking domain to assist the management of banks.

Khan (2010) discussed that security is one of the most important factors in banking services that cause customer satisfaction. He also defined there is a strong relationship between security and customer satisfaction. So, security is one of the major items from all the service quality items that can cause customer satisfaction and dissatisfaction as well. Lin (2011) included ease of use means the level to which the customer perceived that modern banking is easy to recognize and manage.

All type of modern banking usually has user user-friendly appearance, so this quality makes it easier to use for customers, that’s why a customer has positive feelings towards them. Hanafizadeh.P. et.al (2012) discussed that the perception of the individual to adopt modern banking or not depends upon the trust the individual has in the features of modern banking technology. Abduh et al., (2012) illustrated that staff-customer relations, cost of service and accessibility are the critical factors that affect customer satisfaction and influence customer switching behaviours.

Muhammad et al., (2014) in their study on modern banking and customer satisfaction found that responsiveness and reliability have a strong relationship with customer satisfaction while the rest of the variables as security, awareness, ease of use and trust have a moderate relationship with customer satisfaction.

In a similar study, Kant and Jaiswal (2017) stated that responsiveness was found to be the most significant predictor of customer satisfaction. On the other hand, ‘Image’ (Corporate image) has a positive but the least significant relationship with customer satisfaction followed by all constructs.

Zouari and Abdelhedi (2021) in their study found five dimensions of service quality, i.e., confidence, compliance, digitalization, tangibles, and human skills were important in the banking sector.

This study demonstrated a positive and significant relationship between the main dimensions of customer service quality and customer satisfaction, except for tangibles. Tamilselvan et al., (2023) in their study measured the service quality of both public sector and private sector banks using the SERVQUAL scale and it was found that customers of public sector banks are more satisfied with the service quality than those of private sector banks.

In the case of modern banking, there are many dimensions besides the SERVQUAL dimension which play a critical role. Hence, the study has undertaken the previous work and tries to provide a broader view of service quality in Indian modern banking.

III. RESEARCH OBJECTIVES

The main purpose of this study is to test the reliability and validity of SERQUAL and explore the dimensions of the scale among the customers of modern banking in India. The research objectives are given below.

- To assess the normality of the service quality scale in modern banking in India.

- To test and validate the scale in the modern banking system.

IV. RESEARCH METHODOLOGY

A. Sampling, data collection and data analysis

Data was collected between September and December 2023 using convenient sampling. To expand the number of respondents in a short period, a non-probability convenient sampling method (Goodman, 1996) was used. For the pilot survey, a total of 173 respondents data were collected who were the users of modern banking particularly among the college students. A five-point Likert scale was used to measure the perceived service quality which ranged from “1= strongly disagree” to “5= strongly agree”. In addition, a five-point Likert scale ranging from “1 = very dissatisfied” to “5= very satisfied” has been used to measure customer perception and assessment of overall satisfaction. In addition to the original SERVQUAL scale dimensions, other dimensions such as compliance, awareness, image, security, website aesthetics and trust items of the Indian banking service quality scale have been included in the questionnaire. Data analysis (descriptive statistics, reliability analysis, validity analysis and factor analysis) was carried out using SPSS version 20. Demographics are presented as proportions. Cronbach’s alpha was used to assess the reliability and internal consistency of each of the scales.

B. Pilot Study

A pilot study is a small study to test research protocols, data collection instruments, sampling methods, and other research techniques in preparation for a larger study. This study is necessary and useful in providing the groundwork in a research study.

C. Profile of the Participants

A total of 173 valid responses were collected through the convenience sampling method. The data was collected from the respondents during their free time, after obtaining verbal permission from them. The information was entered into an IBM SPSS (Statistical Package for Social Sciences) datasheet, which was then coded and edited as necessary. The missing data imputation technique was utilised to address the challenges caused by missing data. The data was evaluated for normality. It was agreed to proceed with the final analysis after ensuring data normalcy. Table I presents the descriptive statistics of demographics.

Table I: Descriptive Statistics (n = 173)

|

Demography |

Category |

Frequency |

Percentage |

|

Gender |

Male |

100 |

58 |

|

Female |

73 |

42 |

|

|

Education |

Undergraduate |

8 |

5 |

|

Graduate |

38 |

22 |

|

|

Post-Graduate |

101 |

58 |

|

|

Other |

26 |

15 |

|

|

Age |

Less than 25 years |

75 |

43 |

|

25 – 35 years |

38 |

22 |

|

|

35 – 45 years |

40 |

23 |

|

|

45 – 55 years |

9 |

5 |

|

|

55 years and older |

11 |

7 |

|

|

Occupation |

Student |

63 |

36 |

|

Salaried |

81 |

47 |

|

|

Business |

12 |

7 |

|

|

Professional |

17 |

10 |

|

|

Income |

< Rs. 30000 |

36 |

21 |

|

Rs. 30000 – Rs. 60000 |

74 |

43 |

|

|

Rs. 60000 – Rs. 80000 |

25 |

14 |

|

|

Rs. 80000 & Above |

38 |

22 |

D. Questionnaire

This study included a total of 53 adapted questionnaire items. Based on prior literature studies, 53 adapted questionnaire items were considered, including items that considered comparable theories and latent variables that should be verified for normalcy. There were four tangible items, five for reliability, five for responsiveness, five for assurance, four for empathy, four for compliance, four for image, four for trust, five for security, four for awareness, four for website aesthetics, and five for customer satisfaction. Using a 5-point Likert scale, all respondents provided comprehensive responses.

E. Missing Values Analysis

This is a crucial aspect of establishing the acceptability of analysed outputs. Missing values analysis using SPSS 20 was evaluated. An investigation of the items and cases with missing values revealed that the missing data were coming from both direct and indirect data processes and should not be ignored (Hair et al., 2006). Missing data from known processes included those that were displaced due to errors in data input as well as respondents who avoided a few questions. According to Hair et al. (2006), the remedy depends on the degree of missing data and the level of randomness of the missing data process. In this study, the extents of missing data were considered negligible or minor as all items contained very minimal missing values and were way below the acceptable level of 10% (Hair et al., 2006). The crucial findings those supported the current analysis that further analysis using these datasets revealed the absence of any specific pattern amongst the missing data. As a result, all cases (N = 173) that were included in subsequent statistical analysis provided complete details.

V. DATA ANALYSIS

The data analysis for this study begins with checking the dimensionality and reliability of the service quality scale being used for this study, validity in the Indian context and finally analysing the mean responses of the users of banking services towards different scale dimensions. The details have been explained in the following sections.

A. Assessing the Normality of Distribution

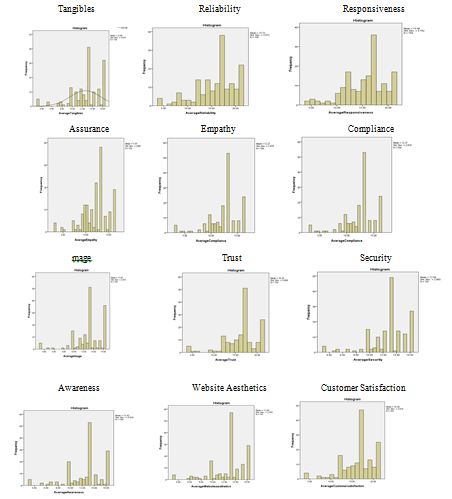

The initial precondition for the statistical test of the hypotheses of the current study is that the existing data must meet the normal distribution pattern. Graphical analysis of data distribution (e.g., histograms) for all of the items comprising the dependent and independent variables including the residual plots was performed to assess normality (Chambers et al., 1983). Table II revealed the skewness and kurtosis of each construct.

Table II: Skewness And Kurtosis Indices Of Factors

|

Constructs |

Skewness |

Kurtosis |

|

Tangibles |

-1.078 |

1.46 |

|

Reliability |

-0.813 |

0.434 |

|

Responsiveness |

-0.741 |

0.502 |

|

Assurance |

-1.191 |

1.57 |

|

Empathy |

-0.692 |

0.801 |

|

Compliance |

-1.052 |

1.682 |

|

Image |

-1.223 |

2.363 |

|

Trust |

-1.214 |

2.37 |

|

Security |

-1.169 |

1.949 |

|

Awareness |

-1.036 |

1.291 |

|

Website Aesthetics |

-1.095 |

1.33 |

|

Customer Satisfaction |

-1.062 |

1.768 |

The descriptive statistics show that the skewness ranged from -1.223 to -.813 while the kurtosis varied from .434 to +2.370. Whilst normal distribution should have values of skewness and kurtosis close to zero (Field, 2005), the values presented in the two tables suggested that the distribution of data was relatively normal.

Conditions of mild skewness (-1 to +1) or kurtosis (-2 to +2) were observed to be within the normal range so that statistical analysis such as factor analysis that would be used in the study could continue (Heck, 1998). Additionally, multiple researchers recommend that absolute values of skewness indices greater than 3.00 seem to describe extremely skewed data sets (Chou and Bentler, 1995; Huet et al., 1992; Kline, 2005; Schumacher and Lomax, 1996). Likewise, absolute values of kurtosis indices higher than 10.00 suggest a problem and values greater than 20.00 may indicate a more serious problem (Hoyle, 1995; Kline, 2005). The data set shows that the skewness and kurtosis were much lower than these maximum limits and pose no problem.

Graphical representation of all the constructs has been shown below to illustrate the pattern of distribution with the help of Histogram.

B. Item Reliability Test

The reliability of the questionnaire is assessed to check the internal consistency of the data based on Cronbach’s alpha. According to L.J. Cronbach (1995), an alpha value greater than 0.70 is considered to be suitable for further analysis. The alpha coefficient for the total number of items is 0.987 (Table III), suggesting that the items have relatively high internal consistency. Reliability was also checked by deleting questions one by one and it was found that there is no significant variation in Cronbach’s alpha. Therefore, it may be concluded that the service quality scale is reliable in modern banking in India. Reliability for construct-wise and items-wise are also highlighted (Table IV).

Table III: Reliability Statistics

|

Cronbach's Alpha |

N of Items |

|

0.987 |

53 |

TABLE IV: Reliability Test of Items and Constructs

|

Construct |

No. of Items |

Cronbach's Alpha |

Construct |

No. of Items |

Cronbach's Alpha |

|

|

Tangibles |

4 |

0.924 |

Image |

4 |

0.946 |

|

|

TANG1 |

|

0.92 |

IMG1 |

|

0.94 |

|

|

TANG2 |

|

0.883 |

IMG2 |

|

0.918 |

|

|

TANG3 |

|

0.906 |

IMG3 |

|

0.92 |

|

|

TANG4 |

|

0.895 |

IMG4 |

|

0.941 |

|

|

Reliability |

5 |

0.934 |

Trust |

5 |

0.947 |

|

|

REL1 |

|

0.916 |

TRU1 |

|

0.936 |

|

|

REL2 |

|

0.913 |

TRU2 |

|

0.928 |

|

|

REL3 |

|

0.912 |

TRU3 |

|

0.933 |

|

|

REL4 |

|

0.919 |

TRU4 |

|

0.933 |

|

|

REL5 |

|

0.933 |

TRU5 |

|

0.943 |

|

|

Responsiveness |

5 |

0.917 |

Security |

4 |

0.947 |

|

|

RESP1 |

|

0.897 |

SECU1 |

|

0.945 |

|

|

RESP2 |

|

0.889 |

SECU2 |

|

0.922 |

|

|

RESP3 |

|

0.889 |

SECU3 |

|

0.933 |

|

|

RESP4 |

|

0.902 |

SECU4 |

|

0.924 |

|

|

RESP5 |

|

0.912 |

Awareness |

4 |

0.96 |

|

|

Assurance |

5 |

0.947 |

AWAR1 |

|

0.953 |

|

|

ASSU1 |

|

0.942 |

AWAR2 |

|

0.937 |

|

|

ASSU2 |

|

0.931 |

AWAR3 |

|

0.945 |

|

|

ASSU3 |

|

0.927 |

AWAR4 |

|

0.954 |

|

|

ASSU4 |

|

0.933 |

Website Aesthetics |

4 |

0.949 |

|

|

ASSU5 |

|

0.938 |

WEB1 |

|

0.937 |

|

|

Empathy |

4 |

0.862 |

WEB2 |

|

0.93 |

|

|

EMPT1 |

|

0.825 |

WEB3 |

|

0.939 |

|

|

EMPT2 |

|

0.823 |

WEB4 |

|

0.927 |

|

|

Table IV: Contd. |

||||||

|

EMPT3 |

|

0.782 |

Customer Satisfaction |

5 |

0.953 |

|

|

EMPT4 |

|

0.86 |

SAT1 |

|

0.94 |

|

|

Compliance |

4 |

0.931 |

SAT2 |

|

0.945 |

|

|

COMP1 |

|

0.929 |

SAT3 |

|

0.94 |

|

|

COMP2 |

|

0.906 |

SAT4 |

|

0.948 |

|

|

COMP3 |

|

0.899 |

SAT5 |

|

0.94 |

|

|

COMP4 |

|

0.906 |

|

|

|

|

C. Item Validity Test

In this study, correlation for data assumed to be normal was calculated using Pearson’s correlation Coefficient two-tailed test with a confidence interval of 95%. The validity of each item was determined by the significance of its correlation coefficient scores (Table V).

It is observed that the correlation is significant at the 0.01 level for all the questions. The sample size is 173. Therefore, the degree of freedom is 171. Using Pearson’s correlation coefficient significant table for the degree of freedom of 171 with a significance level of .05 (Confidence level of 95%), the coefficient of correlation values is greater than the tabulated value. So, all the questions on the scale are valid.

Table V: Item-Total Correlation

|

Items |

r |

Item |

r |

Item |

Coefficient |

|

TANG 1 |

0.756** |

TANG 2 |

0.764** |

TANG 3 |

0.762** |

|

TANG 4 |

0.578** |

REL 1 |

0.791** |

REL 2 |

.794** |

|

REL 3 |

0.773** |

REL 4 |

0.689** |

REL 5 |

0.645** |

|

RESP 1 |

0.836** |

RESP 2 |

0.816** |

RESP 3 |

0.697** |

|

RESP 4 |

0.723** |

RESP 5 |

0.461** |

ASSU 1 |

0.745** |

|

ASSU 2 |

0.836** |

ASSU 3 |

0.820** |

ASSU 4 |

0.767** |

|

ASSU 5 |

0.608** |

EMPT 1 |

0.615** |

EMPT 2 |

0.667** |

|

EMPT 3 |

0.605** |

EMPT 4 |

0.720** |

COMP 1 |

0.693** |

|

COMP 2 |

0.811** |

COMP 3 |

0.793** |

COMP 4 |

0.659** |

|

IMG 1 |

0.855** |

IMG 2 |

0.870** |

IMG 3 |

0.846** |

|

IMG 4 |

0.716** |

TRU 1 |

0.828** |

TRU 2 |

0.812** |

|

TRU 3 |

0.823** |

TRU 4 |

0.736** |

TRU 5 |

0.667** |

|

SECU 1 |

0.836** |

SECU 2 |

0.821** |

SECU 3 |

0.867** |

|

SECU 4 |

0.658** |

AWAR 1 |

0.908** |

AWAR 2 |

0.889** |

|

AWAR 3 |

0.869** |

AWAR 4 |

0.524** |

WEB 1 |

0.890** |

|

WEB 2 |

0.789** |

WEB 3 |

0.885** |

WEB 4 |

0.747** |

|

SAT 1 |

0.865** |

SAT 2 |

0.831** |

SAT 3 |

0.837** |

|

SAT 4 |

0.830** |

SAT 5 |

0.790** |

** Correlation is significant at the 0.01 level (2-tailed)

D. Construct Validity using Exploratory Factor Analysis

The goal of exploratory factor analysis (EFA) is to reduce data to a meaningful factor structure (Yong and Pearce, 2013). EFA is utilized when the researcher does not know the underlying factor (Kim & Mueller, 1978). In other circumstances, where it is previously known, confirmatory factor analysis (CFA) is advised. However, if the scale is utilized with a different population, cultural influences may cause a change in the original component structure, which will not be reflected in the CFA model. In such circumstances, Orcan (2018) proposed that EFA be conducted first before proceeding with CFA. As a result, the service quality scale was first introduced to EFA.

This study has taken 173 responses which are adequate for running the factors analysis (Tabachnick & Fidell, 2005). In addition, the Kaiser-Meyer-Olkin (KMO) is a test for sample adequacy in terms of meeting the best practice standard for EFA (Kaiser, 1970). A KMO value of more than 0.50 is considered adequate (Kaiser, 1974), and values of more than 0.80 are regarded as excellent (Hair et al, 2006). Here the KMO value of 0.942 justifies that the sample is adequate for further analysis (Table VI). Bartlett’s Test of Sphericity helps a researcher to decide whether the results of factor analysis are worth considering and whether he/she should continue analysing the research work. The results were significant.

TABLE VI: KMO AND BARTLETT'S TEST

|

Kaiser-Meyer-Olkin Measure of Sampling Adequacy. |

0.942 |

|

|

Bartlett's Test of Sphericity |

Approx. Chi-Square |

9677.901 |

|

df |

1378 |

|

|

Sig. |

0 |

|

The correlation between the variables is positive and the correlation between customer satisfaction and trust is the highest and between reliability and awareness is the lowest one (Table VII).

Table VII: construct-wise correlation

|

|

TAN |

REL |

RES |

ASSU |

EMP |

COM |

IMG |

TRU |

SEC |

AWA |

WEB |

SAT |

|

TAN |

1 |

0.740** |

0.688** |

0.670** |

0.713** |

0.690** |

0.697** |

0.782** |

0.716** |

0.597** |

0.687** |

0.789** |

|

REL |

|

1 |

0.767** |

0.728** |

0.691** |

0.671** |

0.687** |

0.766** |

0.685** |

0.538** |

0.684** |

0.770** |

|

RES |

|

|

1 |

0.703** |

0.751** |

0.704** |

0.719** |

0.718** |

0.661** |

0.632** |

0.671** |

0.747** |

|

ASSU |

|

|

|

1 |

0.717** |

0.690** |

0.702** |

0.772** |

0.727** |

0.628** |

0.619** |

0.746** |

|

EMP |

|

|

|

|

1 |

0.784** |

0.762** |

0.811** |

0.796** |

0.694** |

0.705** |

0.798** |

|

COM |

|

|

|

|

|

1 |

0.845** |

0.800** |

0.776** |

0.755** |

0.713** |

0.806** |

|

IMG |

|

|

|

|

|

|

1 |

0.836** |

0.764** |

0.660** |

0.763** |

0.816** |

|

TRU |

|

|

|

|

|

|

|

1 |

0.871** |

0.689** |

0.745** |

0.874** |

|

SEC |

|

|

|

|

|

|

|

|

1 |

0.756** |

0.676** |

0.820** |

|

AWA |

|

|

|

|

|

|

|

|

|

1 |

0.612** |

0.695** |

|

WEB |

|

|

|

|

|

|

|

|

|

|

1 |

0.791** |

|

SAT |

|

|

|

|

|

|

|

|

|

|

|

1 |

TAN: Tangibility; REL: Reliability; RES: Responsiveness; ASSU: Assurance; EMP: Empathy; COM: Compliance; IMG: Image; TRU: Trust; SEC: Security; AWA: Awareness; WEB: Website Aesthetics; SAT: Customer Satisfaction.

Conclusion

The technology has brought many changes in the retail banking sector. The existing service quality scale needs to be redefined keeping in mind the requirements of the young and tech-savvy customers. In this regard, the study intends to validate the new service quality scale by including new dimensions. The study has conducted a pilot study taking data from 173 respondents across different demographic sections. It also identified that the new service quality scale is reliable and valid and can be further extended to study considering a greater number of respondents. Further studies can be considered taking satisfaction and other dimensions. The study has taken responses from the limited number of respondents. The study also includes many limitations such as time and the same can be interpreted differently in another banking setup.

References

[1] Abdullah, K., Sukma, R., Jamhari, M., & Musa, M. (2012). Perception and Attitudes toward Terrorism in a Muslim Majority Country, Asian Social Science, 8 (4). http://doi:10.5539/ass.v8n4p77. [2] Al-hawari, M. A. (2015). How the personality of retail bank customers interferes with the relationship between service quality and loyalty, International Journal of Bank Marketing, 33 (1), 41-57. [3] Cronin, J.J., & Taylor, S.A. (1994). SERVPERF versus SERVQUAL: Reconciling performance-based and perceptions-minus-expectations measurement of service quality. Journal of Marketing, 58 (1), 125–131. [4] Ennew, C., & Waite, N. (2013). Financial services marketing: An international guide to practice (2nd ed.). New York, NY: Routledge. [5] Flavian, C., Torres, E., & Guinaliu, M. (2004). Corporate Image Measurement– A further Problem for the Tangibilization of Internet Banking Services, The International Journal of Bank Marketing, 22, 366-384. [6] Fornell, C., Johnson, M.D., Anderson, E.W., Cha, J., & Bryant, B.E. (1996). The American customer satisfaction index: nature, purpose and findings, Journal of Marketing, 60, 7-18. [7] George, A., & Kumar, G. G. (2014). Impact of service quality dimensions in internet banking on customer satisfaction. Decision, 41(1), 73-85. [8] Hammoud, J., Bizri, R.M., & EI Baba, I. (2018). The Impact of E-Banking Service Quality on Customer Satisfaction: Evidence from the Lebanese Banking Sector, Business and Management, 8 (3), 45-68. [9] Hanafizadeh, P., Behboudi, M., Khoshksaray, A., & Shirkhani Tabar, M. (2014). Mobile-banking adoption by Iranian bank clients, Telematics and Informatics, 31(1), 62–78. [10] Jabnoun, N., & Hassan Al?Tamimi, H. A. (2003). Measuring perceived service quality at UAE commercial banks, International Journal of Quality & Reliability Management, 20 (4), 458-472. [11] Kant, R., & Jaiswal, D. (2017). The impact of perceived service quality dimensions on customer satisfaction: an empirical study on public sector banks in India, International Journal of Bank Marketing, 35 (3), 411-430. [12] Khan, M. A. (2010). An Empirical Study of Automated Teller Machine Service Quality and Customer Satisfaction in Pakistani Banks, European Journal of Social Sciences, 13. [13] Kim, J., & Mueller, C.W. (1978) Introduction to factor analysis: What it is and how to do it. Beverly Hills, CA: Sage Publications. [14] Levesque, T., & McDougall, G.H.G. (1996). Determinants of customer satisfaction in retail banking, International Journal of Bank Marketing, 14 (7), 12-20. [15] Lin, H. F. (2011). An empirical investigation of mobile banking adoption: The effect of innovation attributes and knowledge-based trust, International Journal of Information Management, 31(3), 252-260. [16] Muhammad, R., Rehman, A., Rizivi, A., Khan, R., Ayuub, S., Baloch, U., & Sardar, B. (2014). Modern Banking and Customer Satisfaction, International SAMANM Journal of Finance and Accounting, 2 (3), 1-24. [17] Orcan, F. (2013). Exploratory and confirmatory factor analysis: Which one to use first? Journal of Measurement and Evaluation in Education and Psychology, 9(4), 414-421. [18] Othman, A., & Owen, L. (2001). Adopting and measuring customer service quality (SQ) in Islamic banks: A case study in Kuwait Finance House, International Journal of Islamic Financial Services, 3 (1), 1-26. [19] Parasuraman, A., Berry, L., & Zeithaml, V. (1988). SERVQUAL: A multi-item scale for measuring consumer perceptions of SQ , Journal of Retailing, 64, 12-40. [20] Parasuraman, A., Zeithaml, V.A. and Berry, L.L. (1985), “A conceptual model of service quality and its implications for future research”, Journal of Marketing, Vol. 49 No. 1, pp. 26-31. [21] Sathye, M. (2002). Measuring productivity changes in Australian banking: An application of Malmquist indices, Managerial Finance. https://doi.org/10.1108/030743502107 68068. [22] Tamilselvan, M., Muthu, M., John,V., Ramya,K., & Joseph,A.(2023). A Study on Service Quality and Customer Satisfaction Between Public and Private Sector Banks, Journal of Data Acquisition and Processing, 38(2), 1342-1350 [23] Tripathi, S., & Poddar, B. (2011). Being Five Star in Productivity: Roadmap for Excellence in Indian Banking- BCG Report. [24] Yong, A. G. & Pearce, S. (2013). A beginner\'s guide to factor analysis: focusing on exploratory factor analysis, Tutorials in Quantitative Methods for Psychology, 9(2), 79-94. [25] Zeithaml, V. A., Berry, L. L., & Parasuraman, A. (2011). The Behavioral Consequences of Service Quality. Journal of Marketing. https://doi.org/10.2307/1251929. [26] Zouari, G., & Abdelhedi, M. (2021). Customer satisfaction in the digital era: evidence from Islamic banking. Journal of Innovation & Entrepreneurship, 10(9). https://doi.org/10.1186/s13731-021-00151-x

Copyright

Copyright © 2024 Swayansidha Mishra, Dr. Manmath Nath Samantaray. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET64121

Publish Date : 2024-08-30

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online